AI in the Financial Services Industry: Transforming Efficiency, Risk Management, and Customer Experience

Artificial Intelligence (AI) is revolutionizing the financial services industry, driving unprecedented changes across operational efficiency, risk management, fraud detection, and customer engagement. As 91% of financial institutions are either assessing or actively implementing AI, this technology has become a cornerstone of modern finance.

AI’s growing role in finance is reshaping industries globally.

Key Applications of AI in Financial Services

AI is driving transformative change across multiple dimensions of finance, from optimizing back-end operations to enhancing customer-facing services.

Enhancing Operational Efficiency

One of the most significant impacts of AI lies in improving operational efficiency. By automating repetitive tasks, AI allows businesses to allocate resources more effectively, reduce costs, and achieve faster turnaround times. This efficiency is crucial in an era where speed and precision are key to staying competitive.

Examples of AI in Operational Processes

- Data analysis: AI processes vast amounts of information faster than human teams, providing actionable insights for decision-making.

- Regulatory compliance: Automated systems ensure adherence to complex regulations, reducing the risk of non-compliance penalties.

- Real-time trading communications: AI-driven tools enable traders to make split-second decisions with higher accuracy.

At DUYTHIN.DIGITAL, our automation tools empower businesses to enhance their workflows, ensuring they stay ahead of market demands. Learn more about our solutions here.

AI in Risk Management and Fraud Detection

Financial institutions handle massive datasets daily, making them prime targets for fraud and cybersecurity threats. AI excels at identifying anomalous behaviors and detecting fraudulent activities with precision, protecting both businesses and consumers.

Improving Credit Risk Assessments

AI-powered systems use alternative data sources like rent payments, utility bills, and even geolocation to evaluate creditworthiness. This holistic analysis provides a more accurate risk profile, especially in emerging markets where traditional credit data may be unavailable.

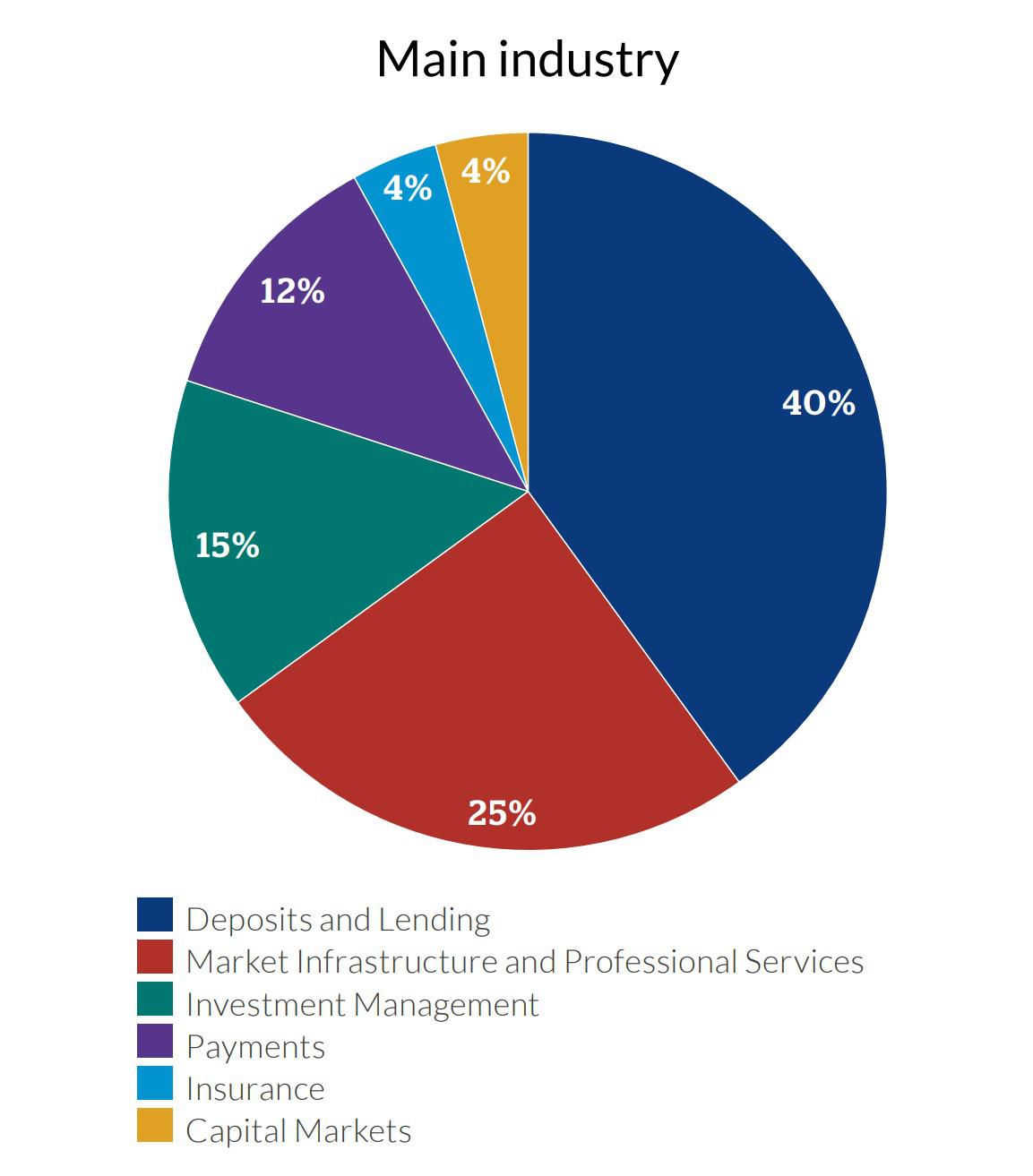

The financial sector leads in adopting AI for risk mitigation.

For example, fintech companies are increasingly relying on AI to manage credit risks efficiently, leveraging data that traditional methods often overlook. Read more about AI’s impact on fintech.

Transforming Customer Experiences

In today’s fast-paced digital world, customers expect seamless and personalized services. AI delivers on these expectations by enabling hyper-personalized interactions and improving overall customer satisfaction.

AI-Powered Chatbots

AI-driven chatbots have revolutionized customer support, offering 24/7 assistance and reducing response times. These tools not only handle routine inquiries but also escalate complex issues to human agents when needed, ensuring a seamless experience.

“With AI-powered chatbots, businesses can deliver tailored solutions to customers instantly, transforming how they interact with financial services.” — Industry Expert

Predictive Analytics for Personalized Offerings

AI analyzes customer behavior to forecast needs and preferences, helping banks and financial firms deliver targeted product recommendations. For instance:

- Suggesting customized investment plans based on spending habits.

- Tailoring loan products to fit individual credit profiles.

AI tools create meaningful, tailored customer engagements.

Revolutionizing Investment and Trading

The use of AI in investment strategies has redefined how financial markets operate, making investment management more efficient and accurate.

Role of Robo-Advisors

Robo-advisors leverage AI to offer personalized investment advice based on an individual’s risk tolerance and financial goals. These systems are not only cost-effective but also provide unbiased, data-driven recommendations.

AI in Forecasting and Portfolio Optimization

By analyzing market trends and historical data, AI tools enhance portfolio performance and improve forecasting accuracy. They enable investors to anticipate market shifts and make proactive decisions, minimizing risks.

AI’s predictive power is a game-changer for investment management.

For more insights on how AI is reshaping investment strategies, check out this article on AI in trading.

Advancing Lending Models

Traditional lending processes are often time-consuming and rigid. AI introduces flexibility and speed, making lending more inclusive and efficient.

Leveraging Alternative Data for Creditworthiness Evaluation

AI systems use unconventional data points like social media activity, employment history, and even purchasing patterns to evaluate a borrower’s creditworthiness. This capability expands access to loans for underbanked populations, driving financial inclusion.

“AI’s ability to analyze non-traditional data sources ensures fairer and more comprehensive credit evaluations.” — CEO, DUYTHIN.DIGITAL

By integrating AI tools into their lending workflows, businesses can serve a broader audience without compromising on risk assessment quality.

Stay tuned for the next section, where we’ll explore emerging trends in financial AI, its economic impact, and the ethical challenges that companies must navigate in this transformative era.