Successful Startup Business Plan Examples

Launching a startup is an exciting journey filled with endless possibilities. However, without a clear and actionable business plan, even the best ideas can falter. A successful startup business plan is more than just a document; it’s the roadmap that guides your venture from concept to profitability. This guide explores effective business plan components and real-world examples to inspire and inform your entrepreneurial journey.

Why a Strong Business Plan Matters

A business plan is the backbone of any startup. It helps articulate your vision, define your goals, and map out the strategies to achieve them. Beyond internal clarity, a compelling business plan is a critical tool for attracting investors, securing loans, and aligning your team.

The Role of Business Plans in Startup Success

Startups that develop detailed business plans are more likely to succeed. A robust plan helps you:

- Identify market opportunities and target audiences.

- Analyze potential risks and how to mitigate them.

- Present a clear financial strategy to stakeholders.

For example, think of a startup like “Doggie Pause,” whose market analysis clearly defined their target demographic, resulting in effective marketing strategies and operational efficiency. Such clarity isn’t accidental—it’s the product of thoughtful business planning.

How Detailed Plans Attract Investors

Investors aren’t just funding your idea; they’re betting on your plan to execute it successfully. A well-prepared business plan demonstrates:

- Credibility: Investors want to know you’ve considered all aspects of your venture.

- Growth Potential: A comprehensive plan showcases how their investment will multiply.

- Strategic Vision: Clear objectives and milestones reassure investors of your business’s trajectory.

External Resource: For tips on crafting a plan that appeals to investors, check out this SBA Business Plan Guide.

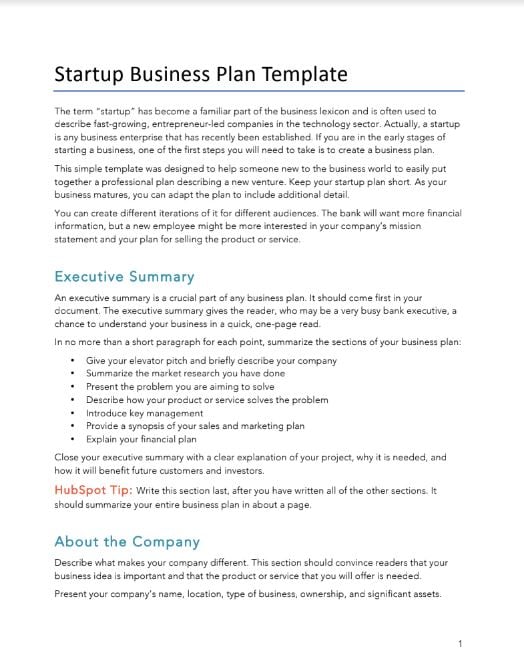

Key Components of a Successful Business Plan

Crafting a winning business plan involves several key components. Each section serves a distinct purpose in conveying your business’s value and viability.

Executive Summary: The First Impression

The executive summary is your elevator pitch in written form. It should be compelling, concise, and highlight the most critical aspects of your business. For instance:

“Maria’s Gluten-Free Bagels offers a dedicated gluten-free menu featuring bagels, breakfast sandwiches, and coffee. Our cafe caters to health-conscious individuals, filling a market gap with minimal competition. We aim to capture 30% of the local gluten-free market within two years.”

This example conveys the unique value proposition and target market succinctly.

Tips for Writing an Effective Executive Summary

- Use clear language to describe your product or service.

- Highlight your target market and competitive edge.

- Keep it brief—no more than one page.

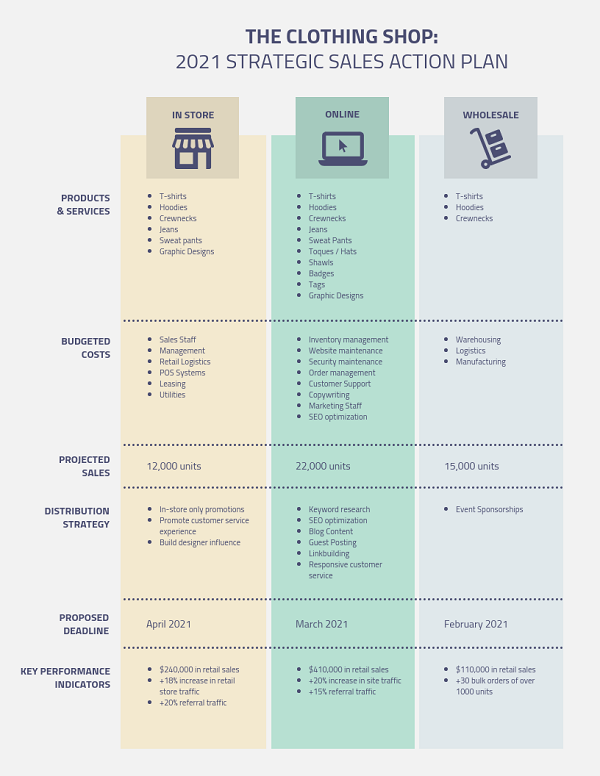

Market Opportunity: Highlighting Potential

Identifying and showcasing your market potential is essential for demonstrating your startup’s scalability. Use concrete data to illustrate demand and growth opportunities.

Example: Doggie Pause

“The market for Doggie Pause includes 2/3 of dog owners in metropolitan areas. We aim to capture a 50% share of this segment, generating a projected 20% annual profit increase.”

This data-backed projection highlights the business’s scope and strategic goals, making it more attractive to investors.

How to Highlight Market Opportunity

- Use demographics and market research to define your audience.

- Include growth trends and potential market share.

- Back up claims with data and credible sources.

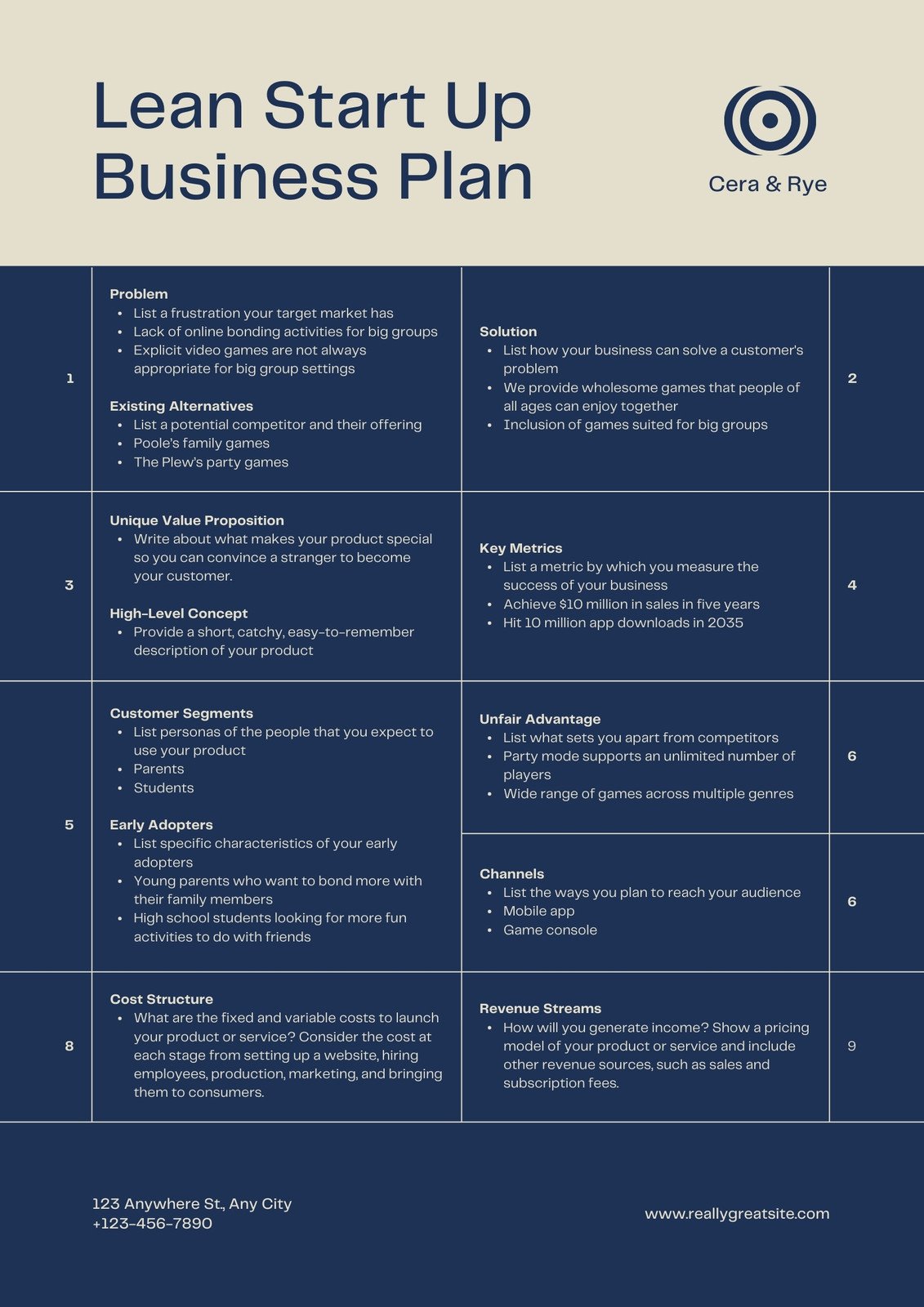

Competitive Analysis: Standing Out in the Market

Understanding your competitors is crucial for crafting a strategy that sets your business apart. A thorough competitive analysis highlights your startup’s unique value proposition.

Example: FireStarters

“FireStarters differentiates itself by offering statement-making products at affordable prices. Unlike major brands, which lack distinctiveness, we focus on delivering unique designs that resonate with fashion-forward customers.”

This example shows how a clear competitive edge can appeal to both customers and investors.

Steps to Conduct Competitive Analysis

- Identify your direct competitors.

- Evaluate their strengths and weaknesses.

- Articulate how your business offers a better solution.

Crafting a Financial Strategy That Resonates

Investors scrutinize your financial plan to determine the feasibility of your business. A well-thought-out financial section includes revenue streams, funding needs, and projected growth.

Elements of a Solid Financial Plan

- Revenue Streams: Detail your income sources, such as product sales or subscriptions.

- Cash Flow Projections: Highlight expected inflows and outflows over time.

- Funding Requirements: Specify how much capital you need and how it will be used.

Example: Early-Stage Funding for Growth

“We seek $200,000 in seed funding to expand production and enhance marketing. Current revenue streams include product pre-sales, generating $50,000 in the last quarter.”

Pro Tips for Financial Planning

- Use realistic projections based on market research.

- Break down your funding allocation into clear categories like operations, marketing, and R&D.

- Prepare a contingency plan for unexpected expenses.

To Be Continued

In the second half of this guide, we’ll dive into marketing strategies, team building, and operational planning, with actionable advice and inspiring examples to refine your business plan further.

At DUYTHIN.DIGITAL, we offer automation tools that can help streamline your marketing efforts and optimize operational efficiency, giving your startup the best chance for success. Stay tuned!